Bitcoin – Why This Time it’s Different

Understanding markets involves understanding trends and recognizing where rises and falls are likely to happen. Bitcoin in 2021, however, has sent many predictions out of the window. Bitcoin has seen bull runs before, but this time, it’s different.

The recent surge in the price of Bitcoin has led to a lot of excitement throughout both the crypto and wider investment community. The higher the price goes, the bigger the hype gets.

Of course, it’s perfectly understandable that we are seeing a lot of fear, uncertainty, and doubt (FUD) right now – in the past the Bitcoin market has followed a fairly predictable and cyclical pattern – rises and new all-time highs (ATH), followed by a bearish period, with a long sell-off until the next bull run begins. Just like any other high-growth investment at all-time high levels, such as Tesla, many are asking: is this the time to sell, and get out?

This time, as before, that’s the wrong question to be asking. The real question should be “how high can it actually go?”

Bitcoin & the four-year halving cycle

Many different indicators are now pointing to Bitcoin potentially breaking free of the 4-year cycle that, so far, it has stuck to. Why does the Bitcoin market function like this? Well, many hold the opinion that a key catalyst for this structure is the four-year halving cycle – this is where the issuance rate of Bitcoin to miners cuts in half every four years, with the combination of reduced supply and sustained demand, sending Bitcoin’s price skyrocketing. This is then historically followed by a correction that leads to a bearish market, one which tends to last until investors start buying back in at rock-bottom prices, and the next halving leads to the cycle starting over again.

So, what caused the corrections in the last two cycles, and how is the scenario different this time?

2013, 2017… 2021

In 2013, we saw the first iteration of the ‘Bitcoin cycle’. The ones who were driving that particular cycle were the ‘early adopters’, people with the technical knowledge to understand the Bitcoin proposition, and those who wanted to use it for purchases on online marketplaces. In 2013, the run was brought to an end by the collapse of Mt. Gox, the most popular bitcoin exchange at the time. Bitcoiners learned a brutal lesson that day: leaving their crypto on exchanges can be dangerous. However, this led to a new generation of crypto enthusiasts who understood how to properly secure their Bitcoin. Out of the ashes, Bitcoin arose stronger than before.

Fast-forward to 2017, and we saw a repeat of this cycle, with many retail investors getting involved for the first time. Still, the cycle was dominated by individuals, with very few institutional investors daring to get on board. Many at this time still saw Bitcoin and crypto as like ‘the Wild West’. This time around, the run came to a halt thanks to a split in the Bitcoin community, which led to a hard fork and the creation of Bitcoin Cash, a rival cryptocurrency. In the end, the hard fork actually proved to be a very profitable event for Bitcoin holders who were left holding two currencies rather than one. It certainly wasn’t the doomsday event some thought it would be.

Now, that brings us to 2021, and the same questions being asked yet again: will history repeat itself? Whilst the one constant when it comes to the Bitcoin price cycle is the Bitcoin halving, the factors that are behind the latest ATH are many and varied. 2021 is different from 2013, and it’s different from 2017.

This time it’s different

Unlike in past years, there is no obvious event on the horizon that could cause Bitcoin to suddenly, and consistently, drop in price. What’s more, there are plenty of exciting developments on the horizon, ones that should only encourage Bitcoin growth – the upcoming CoinBase IPO, the potential approval of a bitcoin ETF by the SEC, and an incoming US stimulus package, just to name a few.

Furthermore, when you take a look at those who are getting involved with Bitcoin this time around, it’s a very different class of investors, to those seen in the last couple of cycles – early-adopters, industry insiders, retail investors. This time they are all on board, but they are no longer the driving force.

Instead, institutions such as JP Morgan – who in the past were skeptical of cryptocurrency – have u-turned and now praise Bitcoin in their investor notes. We have seen the endowment funds of Ivory League universities buying bitcoin in droves. Today major payment providers such as PayPal, Visa, and Mastercard, are implementing cryptocurrency within their platforms.

Companies such as Tesla, MicroStrategy, and Square are suddenly adding Bitcoin to their balance sheets, something that was simply not a factor in previous cycles in the way it is now. And these may just be the first in a long list of companies to do so.

When it comes to retail buyers, this time around there are just so many more ways to get into crypto, with exchanges like Xcoins offering the ability to buy crypto with a single click, there is essentially no barrier to entry in the market now – people can get the basics about Bitcoin from a few articles or videos online – giving them enough understanding to become a first-time Bitcoin investor. And, when it comes to institutional buyers, it’s hard to overstate the importance of having them on board. When a company like Tesla makes a billion-dollar investment in Bitcoin it’s a sign of legitimacy and sends a big signal to the wider financial market that may throw open the floodgates.

Then, there is the question of hype. Overhyping Bitcoin, or any cryptocurrency, usually ends badly – with rises in price ending up being simply just a flash in the plan. In 2021, however, the interest is there, but it’s steadier, which is a good thing. There are also signs that this time the hype is actually far less of a factor than the key fundamentals.

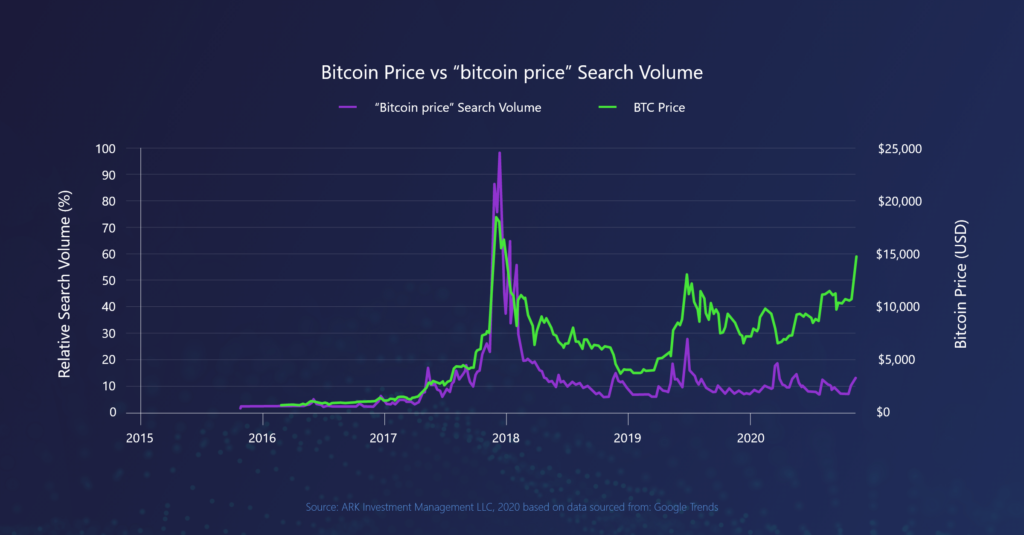

You can see evidence of this in the search trends above. In the past, Google searches for “bitcoin price” almost perfectly correlated with bitcoin purchases, suggesting it was the hype driving the price. This time around, the searches have practically flat-lined, while the price has continued to skyrocket, indicating that it’s something far bigger than mere hype driving the price this time around.

Taken together, this all points towards the likelihood that Bitcoin is now here to stay.

With all this in mind, it’s important to remember that Covid-19 has added another level of complexity to the mix. It’s impacted everything else and Bitcoin has certainly not been left out.

In times of uncertainty, Bitcoin becomes particularly important, and if people trust it as a store of value in times like these, they are likely to trust it even more in times of stability. Recent uncertainty in the international financial markets means that Bitcoin is more and more, being seen as a Gold 2.0. And it’s this factor, growing faith in its true independence and superiority over fiat currency as a store of value that could prove to be the catalyst that drives Bitcoin to finally break out of its 4-year cycle.

The sky’s the limit

So, if a correction or crash doesn’t happen again this time around, then where’s the limit for Bitcoin’s price? Crypto commentators, such as Dan Held from the ‘What Bitcoin Did’ podcast, think that we should be reevaluating what the potential limits of this current Bitcoin bull run should be:

“Close to $1,000,000 is what the KPI would be for a supercycle, and why I like it is that no one is talking about it. No one even thinks that’s possible and everyone just thinks it’s going to do what it did before and it’s a very different environment.” — Dan Held

Recently here at Xcoins, we evaluated claims that supported that proposition and came much to the same conclusion, while such sky-high numbers are absolutely not predestined, it is clear that they do present a real possibility.

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter and LinkedIn and enter your email address at the bottom of the page to subscribe.