The Differences Between Gold and Cryptocurrency Investors: You’ll Be Surprised

Before stocks, shares, and cryptocurrency were available to everyone, gold was the hot topic.

Today’s investors, from casual household savers to companies, still like to invest in gold as it’s commonly viewed as a safe, traditional, long-term investment.

Because these two products differ so much, there are also notable, interesting differences between the types of people who invest in gold and cryptocurrencies.

Using Global Web Index data between 2017 and 2020, we have looked into a number of major differences between gold and cryptocurrency investors – from demographic information to their lifestyle choices and values.

Find out all the differences about these investors below.

Values

The data allowed us to look at the different values each group of investors had. The most interesting stand-out was the fact that crypto investors are 10% more likely to value being successful at work, and 7% more likely to value learning new skills than gold owners, of whom 73% place spending time with their family as the second-most important value in life.

There was one key similarity between gold and cryptocurrency investors, and that was financial security. Both groups valued being financially secure as the most important thing in life.

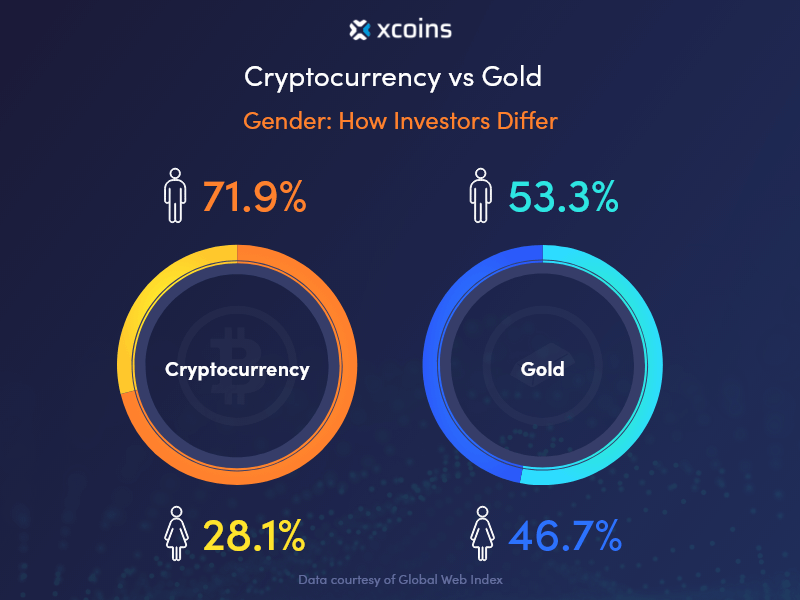

Gender

The most interesting difference between gold and crypto investors comes down to gender. Just 28% of cryptocurrency holders are women, compared to 47% of gold holders.

This makes 72% of cryptocurrency investors male, compared to just 53% of gold investors.

As we covered in our previous blog Do You Know How Much Bitcoin Is Worth? there appears to be a significant gender discrepancy when it comes to cryptocurrency.

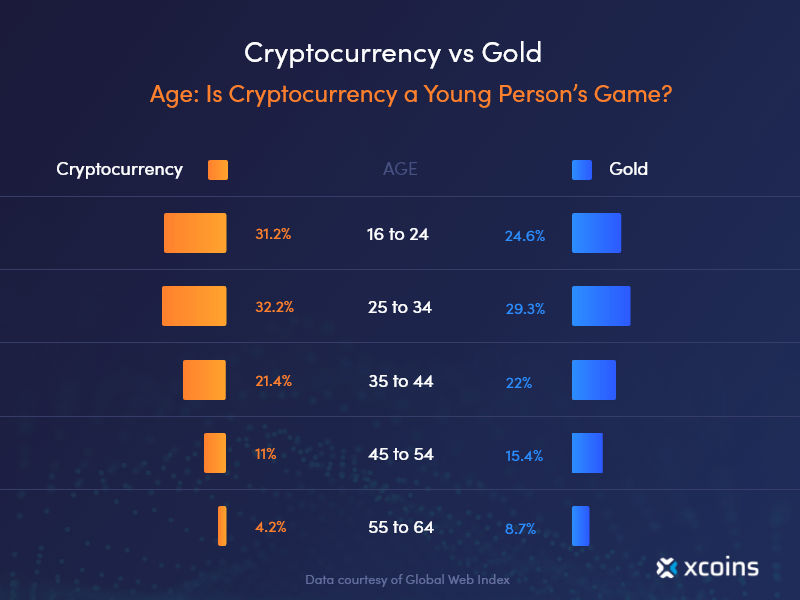

Age

When we segment the data by age, it shows that the majority of gold and cryptocurrency holders are between 16 and 34.

However, younger people are more likely to invest in cryptocurrency. Nearly half (46%) of gold investors are older than 34, compared to just over a third (36%) of those who have invested in cryptocurrency.

Marital Status

Your investment portfolio is usually related to where you are in life at the moment. Retirees and property owners may prefer slower, safer investments, while younger investors may prefer riskier, more lucrative investments.

As a result of this, there are differences between the marital and property status of gold and crypto investors.

More gold investors are married with children compared to crypto investors who, on average, tend to be single with no children.

21% of cryptocurrency investors are renters, while only 15% of gold holders rent their property. This means gold holders are more likely to be “settled down”.

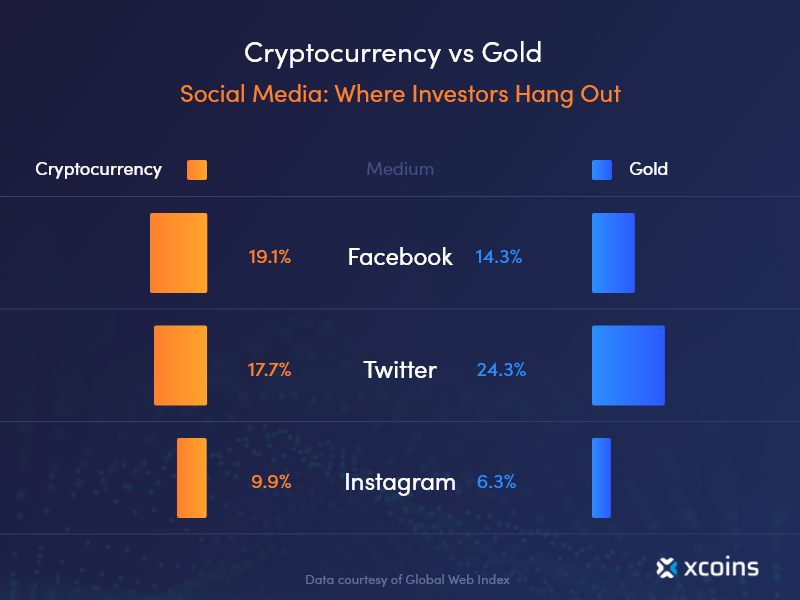

Social Media Use

So, where do gold investors and cryptocurrency holders spend their time online? Knowing where your market resides is a massive advantage and, it turns out, there are clear social media preferences between each type of investor.

Cryptocurrency investors vastly prefer Instagram and Facebook, with 9.9% and 19.1% of holders spending their time there compared to gold’s 6.3% and 14.3%. Gold holders, however, are much more popular on Twitter, with 24.3% saying they’d prefer to hang out there compared to cryptocurrency’s 17.7%.

The reason why each demographic uses social media is different, too. Cryptocurrency holders are more likely to use it to find what’s trending, while gold investors use it to “kill time”.

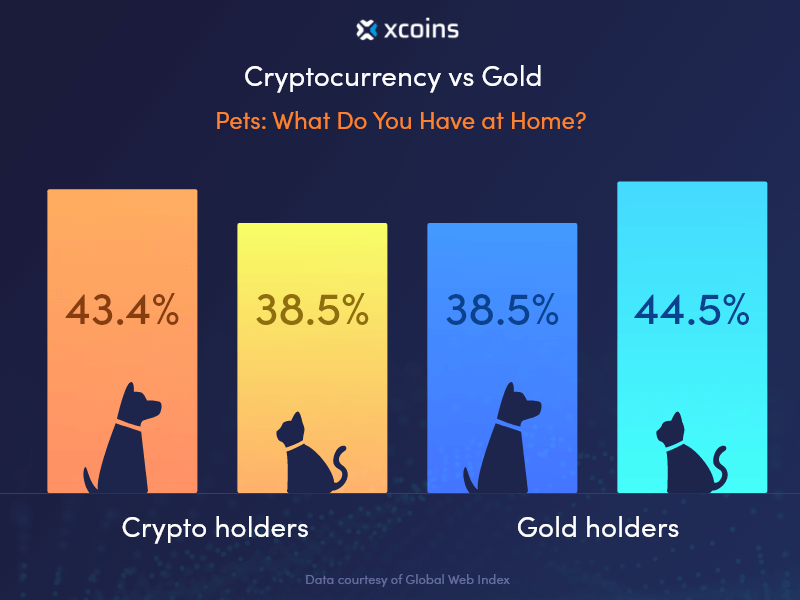

Are You A Cat Or A Dog Person?

Are you a cat person or a dog person? Of course, both are fantastic, but people will always find themselves in one of these two camps. So, how do cryptocurrency and gold investors fair with this question?

Gold investors are more likely to own a cat than cryptocurrency holders (45% to 38%), while cryptocurrency holders tend to be ‘dog people’ (43% to 38%).

Can we read too much into this data? Probably, but it’s an interesting comparison nonetheless. The next time you see someone saying they’re a dog person, maybe it’d be a good idea to introduce them to crypto.

What Does All This Data Mean?

What should we make of all this data, then? Well, while there are clear differences between both groups, these mean there are opportunities to grow cryptocurrency’s appeal in other demographics.

Rob Frye, Xcoins CEO, says:

“If bitcoin is to succeed in the mainstream then it needs support from all demographics. No-one is stopping women from entering or investing the crypto space, but little is being done to encourage them either.

With data suggesting that female investors view cryptocurrency as a riskier investment, it’s clear that more needs to be done in this area to educate and inform people of what risks cryptocurrency actually carries instead of letting assumptions hinder the growth of the asset.”

Bitcoin recently fell 20% from its recent all-time high of $58,000 but has since bounced back above $59,000.

Rob Frye went on to add:

“Bitcoin still remains up over seven-fold compared to a year ago. Seeing a dip like this after its record growth is completely normal and healthy. Interest in the currency is still strong so while we expect Bitcoin to remain volatile, we continue to expect a long-term upwards trend.”

Invest in Crypto With Xcoins Today

As this data shows, there are clear differences between different types of investors. However, this doesn’t mean gold owners will never convert to cryptocurrencies.

As the technology and market mature, these investors will likely make the switch. Our data illustrates that cryptocurrency is still an area of fresh opportunity for all demographics.

Start or continue your investment journey by buying crypto at Xcoins today.

To stay up to date on all things crypto, like Xcoins on Facebook, follow us on Twitter and LinkedIn and enter your email address at the bottom of the page to subscribe.